Making money is so fun, we've even made a game out of it. And then we made money by selling that game to consumers. Coincidence? I think not!

TODAY: Monopolies! We already have a pretty good idea about how markets work in perfect competition. Not all markets are perfectly competitive though: ENTER THE MONOPOLY!

Most Important: There is no competition, and no competitive behavior in monopolies, because in a monopoly market structure, one firm has absolute market power (power to raise and lower the price of a product without losing buyers to competitors).

CHARACTERISTICS OF MONOPOLIES:

1: There is only one seller, so THE FIRM IS THE INDUSTRY

2: This firm is selling a unique, exclusive good which other firms cannot sell (ie: exclusive pharmaceutical drugs which cannot be copied by non-name brand drug companies due to patent restrictions)

3: Entry and Exit into and out of the industry is impossible. In other words, there are insurmountable barriers to entry (and they are often created by the government).

MONOPOLIES ARE PRICE SETTERS! They choose which price to sell their product at.

Let's just do a quick recap for comparison's sake.

PERFECT COMPETITION

-Many Firms

-Selling a Homogenous Good

-Entry and Exit is Easy

-Firms are Price Takers

MONOPOLIES

-Single Firm

-Selling a Unique Good

-Entry and Exit is Impossible

-The Firm is the Price Setter

So, for the most part, a monopoly is the total opposite of perfect competition. The only similarity they share is a total lack of competitive behavior within the market.

----------------------------

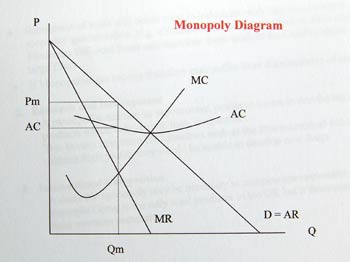

THE DEMAND CURVE FOR THE FIRM IN A MONOPOLY

Well: In a monopoly, the firms is the industry. Logically then, the industry demand is the same as the demand curve for the firm. This means that the demand curve for firms is DOWNWARD SLOPING in monopolies.

We know that monopolists have the freedom to set the price at any level. We know that in a situation of downward sloping demand, consumer demand for a particular good decreases as the price increases. We also know that monopolists, like all producers, will seek to maximize their profits. The question we have to answer then is this:

AT WHAT PRICE WILL MONOPOLISTS SELL TO MAXIMIZE PROFITS?

In order to answer this question, we first need to understand how revenue curves for monopolies work.

First, a chart for revenues with downward sloping demand in effect.

Quantity Demanded--Price--Total Revenue---Average Revenue---Marginal Revenue

0----------------100---0------------------------------------------

1----------------90----90-------------90-----------------90-------

2----------------80----160------------80-----------------70-------

3----------------70----210------------70-----------------50-------

4----------------60----240------------60-----------------30-------

5----------------50----250------------50-----------------10-------

6----------------40----240------------40----------------(-10)------

7----------------30----210------------30----------------(-30)------

8----------------20----160------------20----------------(-50)------

9----------------10----90-------------10----------------(-70)------

10---------------0-----0--------------0-----------------(-90)------

Things you should notice: The average revenue for each of these different potential prices is still equal to the price (just like it was in perfect competition). Marginal revenue, on the other hand, falls twice as quickly as average revenue.

NOTE: As long as marginal revenue is positive, elasticity of demand is greater than one. When marginal revenue = zero, elasticity of demand = 1. When marginal revenue is negative, elasticity of demand is a fraction smaller than 1.

So, why is the marginal revenue always lower than the price (average revenue) for monopolists? Well, in order to sell one more unit of their good, monopolists have to lower the price of that good. This increases demand, so more units will be sold, but at the same time, that lower price will apply to the entire quantity of products sold, including the additional unit which required a lower price in order to sell. As such, the marginal revenue for the 20,323rd iphone sold by apple will be slightly less than the marginal revenue for the 20,322nd iphone.

Monopolists will never produce when the elasticity of demand is negative and marginal revenue is less than zero. Why? because this implies that the firm's total revenue is falling. Firms will not produce extra units if the price adjustment required to sell those extra units creates negative marginal revenue. Firms like profits. Monopolists do not like producing extra units which cost more to produce, and lower total revenue when sold.

When drawing marginal revenue lines, just draw the x-intercept of the marginal revenue line at the midway point between the x intercept of demand and the origin (just trust me, it works)

---------------------------------------

SHORT RUN PROFIT MAXIMIZATION: AT WHAT PRICE WILL MONOPOLISTS SELL TO MAXIMIZE PROFITS?

There are three rules which monopolists must follow to maximize profits.

Rule 1: Monopolists will not produce when elasticity of demand is less than 1. They can only produce when elasticity is equal to or greater than one, or where marginal revenue is equal to or greater than zero (when total revenue is rising). Why? Because for every level of output with elasticity lower than 1, there is another, lower level of output with higher elasticity which will yield the same total revenue, but for a much lower cost (remember, it costs firms to produce units of a good).

Rule 2: A profit maximizing monopolist will produce output where it covers day-to-day expenses (in other words, the price must be higher than the average variable cost)

Rule 3: A profit maximizing monopolist will produce output where marginal revenue equals marginal costs.

SUMMARY:

1: e > or = 1

2: P > or = AVC

3: MR = MC

---------------------------

DIFFERENT SHORT RUN REVENUE SCENARIOS: Here, we're going to look at different revenue scenarios which an affect firms in the short run.

First- we we find the point where MC = MR to determine the profit-maximizing quantity

Then, we find total revenue (price X quantity sold)

Then, we find total costs (average costs X quantity sold)

Finally, we subtract total costs from total revenues to find total profit

SCENARIO 1: Economic Profit!

Here, total revenue is greater than total costs, so economic profit is positive

SCENARIO 2: Normal Profit!

Here, total revenue is equal to total costs, so economic profit is zero

SCENARIO 3: Economic Loss!

Here, total revenue is less than total costs, so economic profit is negative

NOTE: Although there is only one output level which will completely maximize profits, any output quantity where the price (demand) is greater than average costs will render positive economic profits. This gives monopolies some flexibility- they can adjust output to comply with various regulations (ie: lower their output due to environmental legislation) and still reap positive profits.

That's all!