Stock market: are there any opportunities for long term investments?

VietNamNet Bridge – The sickly stock market has been testing stock investors’ patience for many months. Other stock markets have recovered but when will Vietnam’s stock market bounce back?

PVGas could only sell 64 percent of the volume of shares it offered at the IPO (initial public offering) on November 17. The IPO average price of PVGas’ share was 31,000 dong per share.

Becoming shareholders of the enterprise which is leading Vietnam’s gas industry, the key industry in Vietnam’s national economy which decides the development of other industries such as power, fertilizer and steel, is really the dream of many investors. Andy Ho, Investment Director of VinaCapital, said that becoming the “owners” of state-owned general corporations is a golden opportunity which does not come regularly.

However, contrary to previous thoughts, the shares were not selling like hot cakes. Of the 1057 investors who successfully bought the stakes, 12 institutions and 1045 individuals bought 4.244 million stakes out of nearly 61 million of stakes sold.

Money exhausted

A lot of companies reported they could sell only 6-10 percent of the volume of stakes offered. At a recent auction of 7.32 million stakes of a LPG firm in the north, only five individual investors registered to buy 0.6 percent of the volume of shares.

According to Huynh Anh Tuan, General Director of SJC, as money is becoming scarcer investors are becoming more cautious with their investment decisions.

Cash is not flowing into the stock market because of many reasons. Tuan said that there are not many expectations on medium term investments, because the market is still awaiting macroeconomic problems to be solved, including the gold and dollar price fever, and it is still awaiting information about the consumer price index (CPI) in November. The increasing bank interest rates have been creating difficulties for enterprises while investors dare not borrow money and mortgage their shares for the loans.

Many enterprises have licenses to issue shares to increase their chartered capital. However, the enterprises still cannot fix the list of shareholders, because shareholders do not want to spend more money on stakes.

Are there any opportunities?

According to some securities companies, institutions and funds have planned for the disbursement. In October, for example, VF1 fund disbursed, lowering the cash proportion from 10 percent to 7 percent of NAV, and sold all the bonds in its investment portfolio. VF4 also disbursed, while the proportions of cash and other assets have decreased from 7.2 percent to 2.4 percent.

According to Tuan, domestic institutions have disbursed because of the cheap stocks, but they also can see the uncertainties.

“At this moment, they dare not spend too much money. The main force in the stock market is individual investors who account for 80 percent of the trading volume,” he said.

So far this year foreign investors’ net sale has reached over 10 trillion dong or 500 million dollar. According to Au Viet Securities Company, the figure is not big, because in the first quarter of 2008 alone, they incurred a loss of up to $1.3 billion.

Why do foreign investors keep purchasing? According to AVSC, foreign investors always target long term investments (3-5 years), and it is still early to explain their investment strategies.

The advice for investors is to maintain high proportions of cash. However, some analysts believe that if investors have idle money, they should think of medium term investments, because they can expect opportunities when the cash flow of $600 billion is pumped into the US economy and a part of the sum may flow to Vietnam.

Source: Saigon tiep thi

http://english.vietnamnet.vn/en/business/1805/stock-market--are-there-any-opportunities-for-long-term-investments-.html

Exchange Rates and the BOP

FINALLY: EXCHANGE RATES AND THE BALANCE OF PAYMENTS!!!!!!!!!!!!!!

Okay- final bit, and then we can all write our exams and promptly forget everything we ever needed to know about economics! =D

What is a balance of payments? It's a summary account of all the receipts and payments in and out of Canada (or any other country) in relation to the rest of the world (including payments made for both goods and investments). It clocks Canadian money moving back and forth across the border. Receipts are money going into Canada, and payments are money going out of Canada.

The balance of payments includes both current and capital accounts. Because these two accounts always balance out, the balance of payments will always be 0. You'll see why in a little bit.

SOME TERMS

A SURPLUS

-There is more money going in than out

-This is favorable

-We also call this "credit"

-More receipts than payments

A DEFICIT

-There is more money leaving than entering the country

-This is unfavorable

-We also call this a debit

-More payments than receipts

When foreign consumers buy Canadian exports, this creates a receipt (money enters Canada from the outside)

When domestic consumers buy foreign imports, this creates a payment (money leaves Canada)

OFFICIAL RESERVES

-These are holdings held by the BoC

-It includes gold, foreign exchange, and SDRs

-SDRs are special drawing rights, and they are the IMFs substitute for gold

-------------------------------------------

SO WHAT COMPOSES THE BALANCE OF PAYMENTS?

Basically, a bunch of different sub-accounts which measure trade flows

1: The Current Account (The BOP for goods)

-This encompasses exports, imports, and investment incomes

-The Trade Account is a subcategory of the current account, and it includes an account for merchandise, and an account for services. This account stacks up exports and imports and measures the difference difference

-The Capital Service Account measures the net investment income and unilateral money transfers. This measures the difference between Canadian interest and dividends on foreign bonds and investments, and Foreign interest and dividents on Canadian bonds and investments

2: The Capital Account

-This encompasses money spend on long and short term capital investments, including stocks, bonds, realty, factories and other investment devices

-Financial capital imports are A CREDIT (this may be confusing)! This is when foreigners bring money into Canada in order to purchase Canadian assets. Subsequently, financial capital exports are capital outflows: when Canadians bring money out of Canada in order to purchase foreign assets.

-Finally, the Capital account also includes the official financial account, which measures receipts and payments of Canadian dollars due to the selling and buying of foreign exchange. Selling foreign exchange constitutes a receipt of Canadian dollars, and thus counts as a receipt on the balance of payments. Essentially, the official financial account balances out the other two accounts: when Canadians buy a whole lot of foreign goods and investments, for instance, the BoC accommodates this by selling off foreign exchange for Canadian dollars (which thus counteracts the account deficit caused by other categories)

-An increase in official receipts means that the Bank of Canada is selling Canadian dollars in order to buy foreign exchange. This creates a negative balance effect (it counts as a debit on the balance sheet)

-An decrease in official receipts means that the BoC is selling foreign exchange in order to buy Canadian dollars. This creates a positive balance effect (it counts as a credit on the balance sheet)

IN SUMMARY

Current accounts = X - M + Returns to Investments

Capital Accounts = Capital in - Capital out, + Official Financing Account (which is Can$ in - Can$ out)

As you can see, the OFA always balances out all other payments and receipts, so the Balance of Payments is always 0! Sometimes, news media will talk about exchange deficits or credits, and when they are doing this, they are usually omitting the OFA.

So... if there are more exports than imports, foreigners are short of Canadian dollars, so the BoC will sell Canadian currency to foreigners (and in doing so, increase its holdings of foreign currency). This counts as a negative entry in the OFA: in this way, the BoC provides the excess Canadian money that foreigners require to buy Canadian exports.

Okay?

-The BOP always balances

-BOP balances or deficits are balanced out by the OFA

-There is nothing inherently good or bad about balances. A deficit is not necessarily bad, and a surplus is not necessarily good!

THE FLOATING EXCHANGE RATE ACTS AS AN ECONOMIC SHOCK ABSORBER!

----------------------

Okay- foreign exchange can be seen as a marketable good, just like anything else. As such, we have the FOREIGN EXCHANGE MARKET

External Value is how much domestic currency is worth in foreign terms (the foreign price of domestic currency)

Exchange Rate is how much foreign currency is worth in domestic terms (the domestic price of foreign currency)

ER = 1/EV & EV = 1/ER

Depreciation means that the external value is going down

Appreciation means that the external value is going up

What determines external value (and by association, exchange rates)???

SUPPLY AND DEMAND!!!

Remember: People supply currency in order to purchase imports or to facilitate capital exports (domestic investiture into foreign markets) and people demand currency in order to purchase domestic exports, or to facilitate capital imports (foreign investiture into domestic markets)...

Basically, supply of any currency increases as that currency becomes valued more (because high valued currencies can buy more imports, and translate into larger foreign investments), while demand for any currency shrinks as that currency appreciates (because this makes exports from that country more expensive, and capital in-flows less effective)

As such, currency prices tend to settle at an equilibrium value!

Remember, however, that demand and supply can shift here to affect the equilibrium price level!

Supply of currency will increase if

-There is heightened demand for imports

-There is heightened domestic demand for investment in foreign markets

-Domestic prices are higher than foreign prices

Demand for currency will increase if

-There is a heightened demand for exports

-There is a heightened foreign demand for investment in domestic markets

-Foreign prices are higher than domestic prices

-----------------

Surpluses, Deficits, and the EV

For surpluses, exports are higher, imports are low, demand for domestic currency is high, supply of it is low, and thus the currency appreciations

For deficits, exports are lower, imports are high, demand for domestic currency is low, supply of it is high, and this the currency depreciates

You can verify this by moving the supply and demand curves around!

----------------

PRICES AND EXCHANGE RATES: Exchange rates facilitate the rule of one world price!

Domestic Prices = the exchange rate * Foreign Prices

And this translates into a stabilization mechanism- I'll show you!

When external value is higher, domestic prices become cheaper for international goods (due to the above formula), and as such, exports decrease, imports increase, and we are left with a BOT deficit (which brings the EV back down again)

The reverse is true for when the domestic value is lowered.

As such, the balance of trades and the exchange rate are interdependent and cyclical!

YOU SHOULD UNDERSTAND HOW THIS CYCLE WORKS

--------------------------

Okay- final bit, and then we can all write our exams and promptly forget everything we ever needed to know about economics! =D

What is a balance of payments? It's a summary account of all the receipts and payments in and out of Canada (or any other country) in relation to the rest of the world (including payments made for both goods and investments). It clocks Canadian money moving back and forth across the border. Receipts are money going into Canada, and payments are money going out of Canada.

The balance of payments includes both current and capital accounts. Because these two accounts always balance out, the balance of payments will always be 0. You'll see why in a little bit.

SOME TERMS

A SURPLUS

-There is more money going in than out

-This is favorable

-We also call this "credit"

-More receipts than payments

A DEFICIT

-There is more money leaving than entering the country

-This is unfavorable

-We also call this a debit

-More payments than receipts

When foreign consumers buy Canadian exports, this creates a receipt (money enters Canada from the outside)

When domestic consumers buy foreign imports, this creates a payment (money leaves Canada)

OFFICIAL RESERVES

-These are holdings held by the BoC

-It includes gold, foreign exchange, and SDRs

-SDRs are special drawing rights, and they are the IMFs substitute for gold

-------------------------------------------

SO WHAT COMPOSES THE BALANCE OF PAYMENTS?

Basically, a bunch of different sub-accounts which measure trade flows

1: The Current Account (The BOP for goods)

-This encompasses exports, imports, and investment incomes

-The Trade Account is a subcategory of the current account, and it includes an account for merchandise, and an account for services. This account stacks up exports and imports and measures the difference difference

-The Capital Service Account measures the net investment income and unilateral money transfers. This measures the difference between Canadian interest and dividends on foreign bonds and investments, and Foreign interest and dividents on Canadian bonds and investments

2: The Capital Account

-This encompasses money spend on long and short term capital investments, including stocks, bonds, realty, factories and other investment devices

-Financial capital imports are A CREDIT (this may be confusing)! This is when foreigners bring money into Canada in order to purchase Canadian assets. Subsequently, financial capital exports are capital outflows: when Canadians bring money out of Canada in order to purchase foreign assets.

-Finally, the Capital account also includes the official financial account, which measures receipts and payments of Canadian dollars due to the selling and buying of foreign exchange. Selling foreign exchange constitutes a receipt of Canadian dollars, and thus counts as a receipt on the balance of payments. Essentially, the official financial account balances out the other two accounts: when Canadians buy a whole lot of foreign goods and investments, for instance, the BoC accommodates this by selling off foreign exchange for Canadian dollars (which thus counteracts the account deficit caused by other categories)

-An increase in official receipts means that the Bank of Canada is selling Canadian dollars in order to buy foreign exchange. This creates a negative balance effect (it counts as a debit on the balance sheet)

-An decrease in official receipts means that the BoC is selling foreign exchange in order to buy Canadian dollars. This creates a positive balance effect (it counts as a credit on the balance sheet)

IN SUMMARY

Current accounts = X - M + Returns to Investments

Capital Accounts = Capital in - Capital out, + Official Financing Account (which is Can$ in - Can$ out)

As you can see, the OFA always balances out all other payments and receipts, so the Balance of Payments is always 0! Sometimes, news media will talk about exchange deficits or credits, and when they are doing this, they are usually omitting the OFA.

So... if there are more exports than imports, foreigners are short of Canadian dollars, so the BoC will sell Canadian currency to foreigners (and in doing so, increase its holdings of foreign currency). This counts as a negative entry in the OFA: in this way, the BoC provides the excess Canadian money that foreigners require to buy Canadian exports.

Okay?

-The BOP always balances

-BOP balances or deficits are balanced out by the OFA

-There is nothing inherently good or bad about balances. A deficit is not necessarily bad, and a surplus is not necessarily good!

THE FLOATING EXCHANGE RATE ACTS AS AN ECONOMIC SHOCK ABSORBER!

----------------------

Okay- foreign exchange can be seen as a marketable good, just like anything else. As such, we have the FOREIGN EXCHANGE MARKET

External Value is how much domestic currency is worth in foreign terms (the foreign price of domestic currency)

Exchange Rate is how much foreign currency is worth in domestic terms (the domestic price of foreign currency)

ER = 1/EV & EV = 1/ER

Depreciation means that the external value is going down

Appreciation means that the external value is going up

What determines external value (and by association, exchange rates)???

SUPPLY AND DEMAND!!!

Remember: People supply currency in order to purchase imports or to facilitate capital exports (domestic investiture into foreign markets) and people demand currency in order to purchase domestic exports, or to facilitate capital imports (foreign investiture into domestic markets)...

Basically, supply of any currency increases as that currency becomes valued more (because high valued currencies can buy more imports, and translate into larger foreign investments), while demand for any currency shrinks as that currency appreciates (because this makes exports from that country more expensive, and capital in-flows less effective)

As such, currency prices tend to settle at an equilibrium value!

Remember, however, that demand and supply can shift here to affect the equilibrium price level!

Supply of currency will increase if

-There is heightened demand for imports

-There is heightened domestic demand for investment in foreign markets

-Domestic prices are higher than foreign prices

Demand for currency will increase if

-There is a heightened demand for exports

-There is a heightened foreign demand for investment in domestic markets

-Foreign prices are higher than domestic prices

-----------------

Surpluses, Deficits, and the EV

For surpluses, exports are higher, imports are low, demand for domestic currency is high, supply of it is low, and thus the currency appreciations

For deficits, exports are lower, imports are high, demand for domestic currency is low, supply of it is high, and this the currency depreciates

You can verify this by moving the supply and demand curves around!

----------------

PRICES AND EXCHANGE RATES: Exchange rates facilitate the rule of one world price!

Domestic Prices = the exchange rate * Foreign Prices

And this translates into a stabilization mechanism- I'll show you!

When external value is higher, domestic prices become cheaper for international goods (due to the above formula), and as such, exports decrease, imports increase, and we are left with a BOT deficit (which brings the EV back down again)

The reverse is true for when the domestic value is lowered.

As such, the balance of trades and the exchange rate are interdependent and cyclical!

YOU SHOULD UNDERSTAND HOW THIS CYCLE WORKS

--------------------------

Trade Policy

This chapter looks at the policies which either facilitate or impede free trade in the world!

As economists, we usually are in favor of free trade. We recognize that free trade offers many benefits to different countries!

Why is free trade a good idea?

-The law of comparative advantage

-When there is regional specialization and trade, the world production of all products rises

-This maximizes the world's average standard of living (world GDP per capita)

On the other hand, some countries may attempt to instill protectionist policies (policies which counteract free trade in order to protect domestic firms from international competition). These can include both TARIFFS and NON TARIFF BARRIERS (NTBs, such as quotas, customs procedures, anti-dumping duties and countervailing duties).

Why might nation choose certain degrees of protectionism?

REASONS WHICH RELATE TO MAXIMIZING NATIONAL INCOME

1: To improve the terms of trade! If a country is large enough, it can force the world price downward for goods it imports by imposing a Tariff

2: Infant Industry Protection. Some countries may set up trade barriers in order to protect domestic firms from international competition, with the hopes that these industries will grow to the point where they can realize economies of scale. The idea here is that under protection, infant industries will eventually "grow up" to the point where they will be able to compete on the international market without need of protectionism. A problem with this is that not all industries develop to this level of competency while under protection. Canada's national policy of 1876 was an example of infant industry protection directed at improving Canadian manufacturing.

3: Learning by doing. This sort of goes along with infant industry protection, but along with protecting developing industries from international competitors, protectionism can also simply give those industries time to operate, which gives personnel time to gain mastery over certain procedures. In this way, countries can turn comparative disadvantages into comparative advantages.

PROBLEM! Not every industry which gets chosen for protection will ultimately grow up to be an international "winner", so each time the government placed an industry under protection, they are effectively gambling (as protectionism exacts economic costs) on their choice. If governments do this frequently, statistically, they are likely to choose more losers than winners, which would be quite costly.

=(

4: Protectionism can allow certain key industries to earn economic profits and thus innovate more. As such, Canada has strategic trade policy in place with regards to Bombardier (if you remember, they're the company which made the olympic torches)

OTHER REASONS

1: There are advantages from diversification. Countries which are only specialized in a narrow range of products may use protectionism in order to diversify their economies (which gives local firms a "safe space" to expand into new industries, thus increasing the range of products produced domestically). This can be useful in that it buffers the volatility and risk posed by price changes and new technologies by spreading production to several different sectors. The idea here is not to "put all of your eggs in one basket" (although, often, this is more of a political argument than an economic argument)

2: Protectionism lets governments protect favored groups! In Canada, competitive advantage favors skilled labour over unskilled labour, and as a result, free trade may lower the wages of unskilled laborers (who are now competing with wage slaves from overseas). Here, protectionism can redistribute income to certain productive groups, but at the expense of the collective standard of GDP. There is a deadweight loss!

USUALLY, HOWEVER, PROTECTIONISM IS FOR POLITICAL OR FALLACIOUS ECONOMIC REASONS!!!!!!!!! >=(

HERE ARE SOME FAULTY ARGUMENTS WHICH PEOPLE WILL OFTEN POSE IN ORDER TO SUPPORT PROTECTIONISM!

1: "We've got to keep our money at home"

The Premise: If I buy a domestic good, by country will have both the good AND the money used to buy that good

Why it's incorrect: Domestic money is only useful for buying domestic goods. If you are buying foreign products, the money you spend on those products eventually gets used to buy Canadian products- it flows between the two trading countries

2: "We've got to protect ourselves from low-cost foreign labour"

The Premise: Low wage foreign goods will eliminate domestic goods from the market, and thus lower the domestic standard of living.

Why it's incorrect: This goes against the law of comparative advantage. Even if a foreign country can produce all goods at a lower cost than Canada, it would still be advantageous to trade, as trade will lower the opportunity cost of having certain products.

3: "Exports are good, and imports are bad"

The Premise: Exports add to domestic GDP, while imports take away from domestic GDP

Why it's incorrect: Standard of living is dependent on consumption, not production. If a country exports a lot of goods, but derives its comparative advantage by paying its workers very low salaries, then those workers will not be able to consume very many products, on average, and thus that country's standard of living will probably be quite low.

4: "Protectionism creates local jobs"

The Premise: Protecting the domestic market can help save local jobs, and thus combat unemployment

Why it's incorrect: Protectionism reduces employment in other sectors which may have local comparative advantages, and thus, while it may increase employment in one sector, the overall economic effect is inefficient.

-----------------

METHODS OF PROTECTIONISM

TARIFFS: Import Duties- these are a tax on imports. They increase costs for domestic consumers, but benefit domestic producers (who can sell at higher than the world price) and the government (who receives tax revenue). Tariffs create a deadweight social loss for the economy as a whole.

Originally, at the world price, Canada will import 1500 units of this product, and domestic producers will supply the other 500 units needed to satisfy demand.

Once the tariff raises the prices, Canada only imports 500 units of the product, and domestic producers supply the other 1000 units needed to satisfy domestic demand (as you can see, demand has decreased due to the higher price).

Consumer lose surplus represented by sections C, D, E, & F due to the Tariff

Producers gain surplus represented by section C due to the Tariff (the increase in price times the increase in production, minus the costs incurred by increasing production)

The government gains section E due to the Tariff (the quantity of foreign imports at the Tariff price, multiplied by the amount of the Tariff)

SECTIONS D & F REPRESENT A DEADWEIGHT SOCIAL LOSS, HOWEVER! (tragic, isn't it!?)

--------------------------------

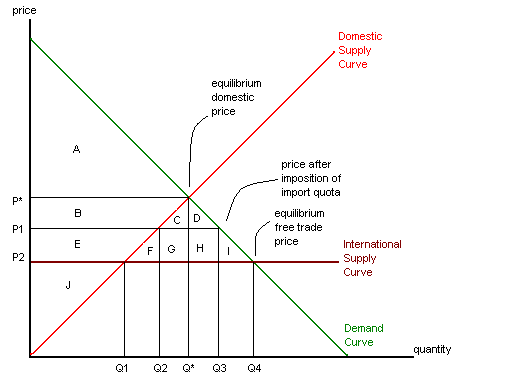

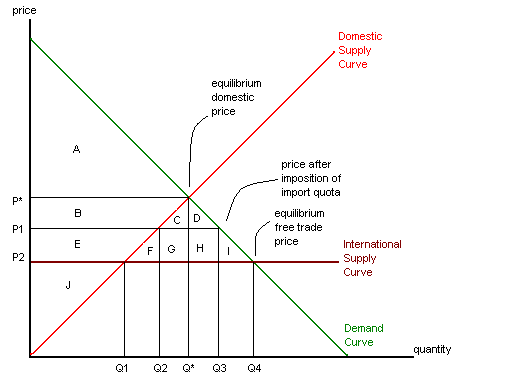

QUOTAS AND VOLUNTARY EXPORT RESTRICTIONS (VERs)

An import quota is like a quantity ceiling- it restricts the quantity of products which a country will import

With a voluntary export restriction, the exporter agrees to limit the amount of exports it will send to any one country.

This incurs costs for domestic consumers, but benefits domestic producers

The net result is a deadweight social loss which is greater than that which results from a Tariff!

At the world price, Canada will import Q4 - Q1, and domestic producers will supply Q1

Let's say that a quota restricts domestic imports to Q3 - Q2. If this happens, then the domestic price must rise to P1, where the quota exactly satisfies the excess demand which domestic producers cannot meet.

Consumers lose surplus equal to E, F, G, H, & I due to the quota,

Producers gain surplus equal to E due to the quota

Since there is no taxation here, the higher price on the quota goods causes foreign producers to gain surplus equal to G & H

THERE IS A DEADWEIGHT LOSS EQUAL TO SECTIONS F & I due to the quota! >=(

Usually, in trade barrier situations, exporters prefer a quota (so they can gain the extra revenue section) while importing governments prefer a tariff (so they can gain the extra revenue section).

----------------------------------------

NON-TARIFF BARRIERS

1: Antidumping Duties

-Dumping is the practice of selling a good in a foreign country at a price below domestic prices at a reason other than costs

-This is like price discrimination (remember from micro) but on an international level

-Usually, it is only temporary, in order to sell off excess supply, or to weaken local industries and force reliance on foreign imports

-It is seen as anti-competitive, and many people believe that it is an unfair form of competition

-Antidumping duties (taxes to bring "dumped" imports back up to the domestic price level) are often used to compensate for this

-Recently, however, these have been abused and used as a non-trade barrier

-When Antidumping Duties are used, the domestic price becomes the price floor, regardless of the foreign price (which can lead to an inflexibility in domestic prices compared to the world price)

-As such, if the world price falls below the average costs for domestic producers, they are protected

-Often, the system requires foreign accusers to prove that dumping is occurring in order for antidumping duties to be instated

2: Countervailing duties: a tariff imposed as a trade remedy to counteract foreign governments subsidizing their industries

-Governments wishing to impose countervailing duties must prove that there is a foreign subsidy being used to bolster a certain foreign industry, and that it is significantly harming the prospects of domestic producers

-The U.S. is currently placing countervailing duties on Canadian softwood lumber.

-----------------------

IMPORTANT ORGANIZATIONS AND TERMS

GATT- The general agreement on trades and tariffs: an effort to reduce international protectionism

The Uruguay Round- reduced tariffs by 40%, but failed to deal with European and Canadian agricultural subsidies (eventually, they ended quotas, but replaced them with Tariffs in a process called Tariffication)

WTO- World trade organization- it has 148 members, it is a global organization which deals with the rules of trade, and it endeavors to lower trade and non-trade barriers. It also includes a formal dispute settlement mechanism

Doha Round- tried to reduce agricultural subsidies

The Battle for Seattle- People protested that human, labour, and environmental rights were not being addressed by the WTO. Interestingly, 3rd world countries often argue against considering these in trade deals

MAI- Multilateral agreement on investment: similar to WTO, but for investments

Free trade Area- Goods and services may move freely among member countries, but each member nation still sets barriers against foreign imports on an individual basis (like NAFTA) PROBLEM: Certain Tariffs have grandfather clauses, and thus persist despite agreements.

Customs Union- A free trade area, but with a common set of barriers against foreign imports (like Mercosur: Brazil, Uruguay, Paraguay, and Argentina)

Common Market- A customs union in which factors of production (i.e., workers) may move freely among member nations (like the EU)

THAT'S ALMOST ALL!!!

As economists, we usually are in favor of free trade. We recognize that free trade offers many benefits to different countries!

Why is free trade a good idea?

-The law of comparative advantage

-When there is regional specialization and trade, the world production of all products rises

-This maximizes the world's average standard of living (world GDP per capita)

On the other hand, some countries may attempt to instill protectionist policies (policies which counteract free trade in order to protect domestic firms from international competition). These can include both TARIFFS and NON TARIFF BARRIERS (NTBs, such as quotas, customs procedures, anti-dumping duties and countervailing duties).

Why might nation choose certain degrees of protectionism?

REASONS WHICH RELATE TO MAXIMIZING NATIONAL INCOME

1: To improve the terms of trade! If a country is large enough, it can force the world price downward for goods it imports by imposing a Tariff

2: Infant Industry Protection. Some countries may set up trade barriers in order to protect domestic firms from international competition, with the hopes that these industries will grow to the point where they can realize economies of scale. The idea here is that under protection, infant industries will eventually "grow up" to the point where they will be able to compete on the international market without need of protectionism. A problem with this is that not all industries develop to this level of competency while under protection. Canada's national policy of 1876 was an example of infant industry protection directed at improving Canadian manufacturing.

3: Learning by doing. This sort of goes along with infant industry protection, but along with protecting developing industries from international competitors, protectionism can also simply give those industries time to operate, which gives personnel time to gain mastery over certain procedures. In this way, countries can turn comparative disadvantages into comparative advantages.

PROBLEM! Not every industry which gets chosen for protection will ultimately grow up to be an international "winner", so each time the government placed an industry under protection, they are effectively gambling (as protectionism exacts economic costs) on their choice. If governments do this frequently, statistically, they are likely to choose more losers than winners, which would be quite costly.

=(

4: Protectionism can allow certain key industries to earn economic profits and thus innovate more. As such, Canada has strategic trade policy in place with regards to Bombardier (if you remember, they're the company which made the olympic torches)

OTHER REASONS

1: There are advantages from diversification. Countries which are only specialized in a narrow range of products may use protectionism in order to diversify their economies (which gives local firms a "safe space" to expand into new industries, thus increasing the range of products produced domestically). This can be useful in that it buffers the volatility and risk posed by price changes and new technologies by spreading production to several different sectors. The idea here is not to "put all of your eggs in one basket" (although, often, this is more of a political argument than an economic argument)

2: Protectionism lets governments protect favored groups! In Canada, competitive advantage favors skilled labour over unskilled labour, and as a result, free trade may lower the wages of unskilled laborers (who are now competing with wage slaves from overseas). Here, protectionism can redistribute income to certain productive groups, but at the expense of the collective standard of GDP. There is a deadweight loss!

USUALLY, HOWEVER, PROTECTIONISM IS FOR POLITICAL OR FALLACIOUS ECONOMIC REASONS!!!!!!!!! >=(

HERE ARE SOME FAULTY ARGUMENTS WHICH PEOPLE WILL OFTEN POSE IN ORDER TO SUPPORT PROTECTIONISM!

1: "We've got to keep our money at home"

The Premise: If I buy a domestic good, by country will have both the good AND the money used to buy that good

Why it's incorrect: Domestic money is only useful for buying domestic goods. If you are buying foreign products, the money you spend on those products eventually gets used to buy Canadian products- it flows between the two trading countries

2: "We've got to protect ourselves from low-cost foreign labour"

The Premise: Low wage foreign goods will eliminate domestic goods from the market, and thus lower the domestic standard of living.

Why it's incorrect: This goes against the law of comparative advantage. Even if a foreign country can produce all goods at a lower cost than Canada, it would still be advantageous to trade, as trade will lower the opportunity cost of having certain products.

3: "Exports are good, and imports are bad"

The Premise: Exports add to domestic GDP, while imports take away from domestic GDP

Why it's incorrect: Standard of living is dependent on consumption, not production. If a country exports a lot of goods, but derives its comparative advantage by paying its workers very low salaries, then those workers will not be able to consume very many products, on average, and thus that country's standard of living will probably be quite low.

4: "Protectionism creates local jobs"

The Premise: Protecting the domestic market can help save local jobs, and thus combat unemployment

Why it's incorrect: Protectionism reduces employment in other sectors which may have local comparative advantages, and thus, while it may increase employment in one sector, the overall economic effect is inefficient.

-----------------

METHODS OF PROTECTIONISM

TARIFFS: Import Duties- these are a tax on imports. They increase costs for domestic consumers, but benefit domestic producers (who can sell at higher than the world price) and the government (who receives tax revenue). Tariffs create a deadweight social loss for the economy as a whole.

Originally, at the world price, Canada will import 1500 units of this product, and domestic producers will supply the other 500 units needed to satisfy demand.

Once the tariff raises the prices, Canada only imports 500 units of the product, and domestic producers supply the other 1000 units needed to satisfy domestic demand (as you can see, demand has decreased due to the higher price).

Consumer lose surplus represented by sections C, D, E, & F due to the Tariff

Producers gain surplus represented by section C due to the Tariff (the increase in price times the increase in production, minus the costs incurred by increasing production)

The government gains section E due to the Tariff (the quantity of foreign imports at the Tariff price, multiplied by the amount of the Tariff)

SECTIONS D & F REPRESENT A DEADWEIGHT SOCIAL LOSS, HOWEVER! (tragic, isn't it!?)

--------------------------------

QUOTAS AND VOLUNTARY EXPORT RESTRICTIONS (VERs)

An import quota is like a quantity ceiling- it restricts the quantity of products which a country will import

With a voluntary export restriction, the exporter agrees to limit the amount of exports it will send to any one country.

This incurs costs for domestic consumers, but benefits domestic producers

The net result is a deadweight social loss which is greater than that which results from a Tariff!

At the world price, Canada will import Q4 - Q1, and domestic producers will supply Q1

Let's say that a quota restricts domestic imports to Q3 - Q2. If this happens, then the domestic price must rise to P1, where the quota exactly satisfies the excess demand which domestic producers cannot meet.

Consumers lose surplus equal to E, F, G, H, & I due to the quota,

Producers gain surplus equal to E due to the quota

Since there is no taxation here, the higher price on the quota goods causes foreign producers to gain surplus equal to G & H

THERE IS A DEADWEIGHT LOSS EQUAL TO SECTIONS F & I due to the quota! >=(

Usually, in trade barrier situations, exporters prefer a quota (so they can gain the extra revenue section) while importing governments prefer a tariff (so they can gain the extra revenue section).

----------------------------------------

NON-TARIFF BARRIERS

1: Antidumping Duties

-Dumping is the practice of selling a good in a foreign country at a price below domestic prices at a reason other than costs

-This is like price discrimination (remember from micro) but on an international level

-Usually, it is only temporary, in order to sell off excess supply, or to weaken local industries and force reliance on foreign imports

-It is seen as anti-competitive, and many people believe that it is an unfair form of competition

-Antidumping duties (taxes to bring "dumped" imports back up to the domestic price level) are often used to compensate for this

-Recently, however, these have been abused and used as a non-trade barrier

-When Antidumping Duties are used, the domestic price becomes the price floor, regardless of the foreign price (which can lead to an inflexibility in domestic prices compared to the world price)

-As such, if the world price falls below the average costs for domestic producers, they are protected

-Often, the system requires foreign accusers to prove that dumping is occurring in order for antidumping duties to be instated

2: Countervailing duties: a tariff imposed as a trade remedy to counteract foreign governments subsidizing their industries

-Governments wishing to impose countervailing duties must prove that there is a foreign subsidy being used to bolster a certain foreign industry, and that it is significantly harming the prospects of domestic producers

-The U.S. is currently placing countervailing duties on Canadian softwood lumber.

-----------------------

IMPORTANT ORGANIZATIONS AND TERMS

GATT- The general agreement on trades and tariffs: an effort to reduce international protectionism

The Uruguay Round- reduced tariffs by 40%, but failed to deal with European and Canadian agricultural subsidies (eventually, they ended quotas, but replaced them with Tariffs in a process called Tariffication)

WTO- World trade organization- it has 148 members, it is a global organization which deals with the rules of trade, and it endeavors to lower trade and non-trade barriers. It also includes a formal dispute settlement mechanism

Doha Round- tried to reduce agricultural subsidies

The Battle for Seattle- People protested that human, labour, and environmental rights were not being addressed by the WTO. Interestingly, 3rd world countries often argue against considering these in trade deals

MAI- Multilateral agreement on investment: similar to WTO, but for investments

Free trade Area- Goods and services may move freely among member countries, but each member nation still sets barriers against foreign imports on an individual basis (like NAFTA) PROBLEM: Certain Tariffs have grandfather clauses, and thus persist despite agreements.

Customs Union- A free trade area, but with a common set of barriers against foreign imports (like Mercosur: Brazil, Uruguay, Paraguay, and Argentina)

Common Market- A customs union in which factors of production (i.e., workers) may move freely among member nations (like the EU)

THAT'S ALMOST ALL!!!

Gains from International Trade

OKAY! Let's talk turkey about international trade.

Over time, while world GDP had been increasing at a fairly constant rate, world trade has increased exponentially!

Canada is, itself, involved in quite a bit of international trade (we export and import quite a lot of goods)

David Rciardo was an economist of lore (1772-1823), and he was a major proponent of international trade. He wrote "Current comparative advantage is a major determinant of trade under free-market conditions."

Economists who advocated world trade often promoted teachings which led to real changes, such as England repealing its corn laws and moving towards a more open economy (an open economy is one which engages in international free trade, and realizes certain advantages from this, known as the gains from trade).

GAINS FROM TRADE: These are increases in total economic output due to efficiency advantages resulting from local economies engaging in specialization and trade of goods in which they have a comparative advantage.

COMPARATIVE ADVANTAGE: A situation where one local economy can produce a certain good at a lower opportunity cost than other economies (i.e., if it is less expensive for Canada to grow wheat than it is for Haiti to grow wheat, then we would state that Canada has a comparative advantage in wheat)

WHAT IS THE LOGIC BEHIND INTERNATIONAL TRADE? It's the same logic which states that interpersonal trade will be beneficial!

-When there is no trade on an interpersonal level, each individual has to be self-sufficient: they must provide for all of their own needs

-Trade allows individuals to specialize in providing goods and services which they can produce or provide efficiently, and then trade those for goods and services which they are less proficient at providing.

For an example, if I am a Doctor, I could be very very good at fixing coronary blockages, but terrible at fixing pipes. Trade means that I can simply make money by acting as a doctor, and then trade this money to "borrow" a trained plumber, thus saving me hours of frustration and reading complicated instructions. In this situation, both me and the plumber are providing the services which we are most efficient in, and because I don't have to waste time learning how to fix pipe and he doesn't have to waste time memorizing human anatomy, the overall economic output between the two of us is higher! We are more efficient when we can divide and conquer! =D

Well... interregional and international trade follows the same logic!

There are two different sources of gains from international trade:

1- The fact that different local economies have different resource endowments (and therefore can benefit from specializing in producing products which fit well with regional endowments, both natural and acquired)

2- The fact that international trade leads to a larger market for products means that local firms can realize reductions in production costs due to increased production (they are able to achieve economies of scale)

---------------------------------

ABSOLUTE ADVANTAGE: This is when one country (or economy), compared to another, can produce more of a good from the same inputs

So, lets say that given the same inputs...

Canada can produce 10 bushels of wheat or 6 lengths of cloth

England can produce 5 bushels of wheat or 10 lengths of cloth

Canada has an absolute advantage over England in terms of wheat, and England has an absolute advantage of Canada in terms of cloth. Here, we have a situation of reciprocal advantage (each country is more adept at producing a different good), and thus it will be advantageous for England and Canada to trade!

WHY?!

Because each unit of input which Canada switched from cloth production to wheat production leads to 6 fewer cloths, but 10 more wheat. Similarly, each unit of input which England switched from wheat production to cloth production leads to 5 fewer wheat and 10 more cloth. The net effect of this is that the world production of both wheat and cloth has increased if both the countries specialize in what they are best at producing: there are worldwide gains from specialization.

But English and Canadian consumers want to purchase both goods... so unless these countries are able to trade, this specialization would not be practical.

----------------------------

THE LAW OF COMPARATIVE ADVANTAGE

Lets say that using one unit of input...

Canada can produce 100 bushels of wheat or 60 lengths of cloth

England can produce 5 units of wheat or 10 length of cloth

Here, Canada has can absolute advantage in both wheat and cloth (so Canada is more efficient at producing either of these products). Some people might think that Canada should thus not engage in trade... but they would be WRONG! Dead WRONG!

Canada can produce 20 times as much wheat at England, but only 6 times as much cloth using one unit of input. From this, we can surmise that Canada has a COMPARATIVE ADVANTAGE in wheat, while England has a comparative advantage in cloth.

Each country should trade goods in which it has a comparative advantage. Trade, in this case, increases the world's per-capita GDP. Comparative advantage is a necessary and sufficient condition for trade. Absolute advantages (in the absence of comparative advantages) do no lead to gains from trade.

How do we figure out which product a country has a comparative advantage in?

Easy! You just calculate the opportunity cost of producing any one good. Given the previous example, the OC of producing 100 bushels of wheat in Canada is 60 lengths of cloth, so the opportunity cost of each bushel of wheat is 0.6 lengths of cloth. Similarly, the OC of producing is length of cloth is 1.67 bushels of wheat for Canada. The opportunity cost for England of producing 1 length of cloth is 0.50 bushels of wheat, and the opportunity cost for England of producing 1 bushel of wheat is 2 lengths of cloth!

The opportunity cost of wheat is lower in Canada than in England, so Canada has a comparative advantage in wheat

The opportunity cost of cloth is lower in England than in Canada, so England has a comparative advantage in cloth

The point: opportunity cost depends on relative costs, no absolute costs!

WHENEVER OPPORTUNITY COSTS DIFFER, SPECIALIZATION AND TRADE CAN INCREASE THE WORLD PRODUCTION OF BOTH COMMODITIES, WHICH LEADS TO INCREASED CONSUMPTION POSSIBILITIES

*to note: increased production does not necessarily lead to increased consumption, and standard of living depends on consumption rather than production (so a country could produce a whole lot of products, but if its workers make very low factor incomes, and are hence unable to consume many goods, that country's standard of living may still be extremely low.)

ABSOLUTE ADVANTAGE DOES NOT LEAD TO GAINS FROM TRADE!

If Canada can produce 100 wheats or 60 cloths given one unit of input

and England can produce 10 wheats or 6 cloths given one unit of input

Canada has the same absolute advantage of England in terms of both products, but each country has the same opportunity costs in terms of producing each good. Because of this, specialization and trade will NOT lead to any gains for either country, nor will it increase world output of either product.

There are other reasons in addition to comparative advantage that can make it beneficial to engage in specialization and trade

Basically, whenever OC's differ for the same products between different countries, specialization (and subsequent trade) leads to an increase in net production of goods, and as a result, a decrease in costs, because of...

1: Economies of Scale- Trade creates a larger market for domestic producers (who, after international trade, provide products for consumers around the world instead of just domestically)

2: Product Differentiation- A large international market for any type of product leads to further specialization, or product differentiation. For an example, in Europe, each country specializes in intra-industry trade. Between Canada and the U.S., each country specializes in a different type of car.

3: Learning by doing- Larger international markets lead to specialization, which leads to "accumulated experience". For an example, the silicon valley area of the United States has gained a reputation for computerized innovation, and as a result of that specialization, people from that area gain experience over time, and become better-equiped to compete in that industry.

Economies of Scale = Production moves to the bottom of the LRAC

Learning by Doing = The entire LRAC shifts downward, so any level of production costs less

-------------------------------------

SOURCES OF COMPARATIVE ADVANTAGE:

1: Natural Factor Endowments

-This is how traditional economists explained comparative advantages

-What each country is "born with"

-This includes both natural resources and climates, as well as social patterns and institutional set-ups

-This natural resource advantage translates into cost advantages (i.e., a very fertile country will not incur as many costs growing food as an arid country)

2: Acquired Comparative Advantages

-This is a newer idea: what each country DEVELOPS can lead to a comparative advantage in certain products

-For an example, social fixtures such as education, healthcare, and social services can create more productive workers

-Research and development can also lead to innovations and localized experience which gives certain nations comparative advantages in certain sectors (like Canada and aerospace engineering, or Korea and shipbuilding)

-------------------------

PATTERNS OF INTERNATIONAL TRADE:

We know that countries should specialize and then trade in goods in which they have a comparative advantage.

So... do countries actually export those goods in which they have a comparative advantage? The answer is YESSSSSSS!

THE LAW OF ONE WORLD PRICE: Internationally traded goods sell at the same price, regardless of which country they are sold in, assuming

-zero transport costs

-it is actually the same good

-competitive markets

-the good is tradable

World price simply equates global supply and demand for any product to determine the equilibrium price

So.........

If one country has a comparative advantage in a certain product which would potentially lead to a lower domestic price for this product than the world price level, instead of simply selling the product at the domestic price level, that country will sell that product on the world market at the (higher) world price level: the domestic excess supply will get sold off on the international market.

THE THEORY OF COMPARATIVE ADVANTAGE IS STILL RELEVANT~!! Sources of those competitive advantages may have changed over the years, but the basic premise of this theory still holds true!

------------------------------------

TERMS OF TRADE: These determine how the gains from trade are shared- in other words, how will the gains in world per-capita GDP be shared among the trading nations.

The Terms of Trade = the ratio of (the price of exports / the price of imports)

OR

The relative international price of imports (how many imports can be purchased per unit of export)

If the terms of trade increase, this is favorable for the nation in question, because they are able to get more imports per export. The reverse is true if the terms of trade decrease.

Unfavorable terms of trade will not be conducive to trade! Basically, if the terms of trade make it so that the OC of obtaining imports is equal to or greater than the OC of producing a product domestically, the country in question will not trade for that product! There needs to be a win-win situation (terms of trade which allow for both countries to enjoy lowered OCs) in order to trade to occur.

-----------------------

International Trade and the PPC:

When there is trade, consumption can differ from production! This means that trade can facilitate changes in production which allow for patterns of consumption which lie outside the PPC!

The slope of the dotted line = the terms of trade (tt)

Basically, given any point on the original PPC, international trade allows that country to trade products with another country at a rate which differs from that given on the PPC (which is usually convex). As you can see, if the country in the diagram specializes and trades, it can reach point B!

By specializing (changing production), countries can optimize their production in order to best take advantage of good terms of trade!

NOTE: Which country wins depends on the terms of trade (the slope of the line). Also, the consumption pattern (the point on the CPC) which each country settles into will depend on their preferences between the two products being compared.

Also, most countries have increasing OCs with increased specialization, and thus they have convex PPCs

That's all for now!

Over time, while world GDP had been increasing at a fairly constant rate, world trade has increased exponentially!

Canada is, itself, involved in quite a bit of international trade (we export and import quite a lot of goods)

David Rciardo was an economist of lore (1772-1823), and he was a major proponent of international trade. He wrote "Current comparative advantage is a major determinant of trade under free-market conditions."

Economists who advocated world trade often promoted teachings which led to real changes, such as England repealing its corn laws and moving towards a more open economy (an open economy is one which engages in international free trade, and realizes certain advantages from this, known as the gains from trade).

GAINS FROM TRADE: These are increases in total economic output due to efficiency advantages resulting from local economies engaging in specialization and trade of goods in which they have a comparative advantage.

COMPARATIVE ADVANTAGE: A situation where one local economy can produce a certain good at a lower opportunity cost than other economies (i.e., if it is less expensive for Canada to grow wheat than it is for Haiti to grow wheat, then we would state that Canada has a comparative advantage in wheat)

WHAT IS THE LOGIC BEHIND INTERNATIONAL TRADE? It's the same logic which states that interpersonal trade will be beneficial!

-When there is no trade on an interpersonal level, each individual has to be self-sufficient: they must provide for all of their own needs

-Trade allows individuals to specialize in providing goods and services which they can produce or provide efficiently, and then trade those for goods and services which they are less proficient at providing.

For an example, if I am a Doctor, I could be very very good at fixing coronary blockages, but terrible at fixing pipes. Trade means that I can simply make money by acting as a doctor, and then trade this money to "borrow" a trained plumber, thus saving me hours of frustration and reading complicated instructions. In this situation, both me and the plumber are providing the services which we are most efficient in, and because I don't have to waste time learning how to fix pipe and he doesn't have to waste time memorizing human anatomy, the overall economic output between the two of us is higher! We are more efficient when we can divide and conquer! =D

Well... interregional and international trade follows the same logic!

There are two different sources of gains from international trade:

1- The fact that different local economies have different resource endowments (and therefore can benefit from specializing in producing products which fit well with regional endowments, both natural and acquired)

2- The fact that international trade leads to a larger market for products means that local firms can realize reductions in production costs due to increased production (they are able to achieve economies of scale)

---------------------------------

ABSOLUTE ADVANTAGE: This is when one country (or economy), compared to another, can produce more of a good from the same inputs

So, lets say that given the same inputs...

Canada can produce 10 bushels of wheat or 6 lengths of cloth

England can produce 5 bushels of wheat or 10 lengths of cloth

Canada has an absolute advantage over England in terms of wheat, and England has an absolute advantage of Canada in terms of cloth. Here, we have a situation of reciprocal advantage (each country is more adept at producing a different good), and thus it will be advantageous for England and Canada to trade!

WHY?!

Because each unit of input which Canada switched from cloth production to wheat production leads to 6 fewer cloths, but 10 more wheat. Similarly, each unit of input which England switched from wheat production to cloth production leads to 5 fewer wheat and 10 more cloth. The net effect of this is that the world production of both wheat and cloth has increased if both the countries specialize in what they are best at producing: there are worldwide gains from specialization.

But English and Canadian consumers want to purchase both goods... so unless these countries are able to trade, this specialization would not be practical.

----------------------------

THE LAW OF COMPARATIVE ADVANTAGE

Lets say that using one unit of input...

Canada can produce 100 bushels of wheat or 60 lengths of cloth

England can produce 5 units of wheat or 10 length of cloth

Here, Canada has can absolute advantage in both wheat and cloth (so Canada is more efficient at producing either of these products). Some people might think that Canada should thus not engage in trade... but they would be WRONG! Dead WRONG!

Canada can produce 20 times as much wheat at England, but only 6 times as much cloth using one unit of input. From this, we can surmise that Canada has a COMPARATIVE ADVANTAGE in wheat, while England has a comparative advantage in cloth.

Each country should trade goods in which it has a comparative advantage. Trade, in this case, increases the world's per-capita GDP. Comparative advantage is a necessary and sufficient condition for trade. Absolute advantages (in the absence of comparative advantages) do no lead to gains from trade.

How do we figure out which product a country has a comparative advantage in?

Easy! You just calculate the opportunity cost of producing any one good. Given the previous example, the OC of producing 100 bushels of wheat in Canada is 60 lengths of cloth, so the opportunity cost of each bushel of wheat is 0.6 lengths of cloth. Similarly, the OC of producing is length of cloth is 1.67 bushels of wheat for Canada. The opportunity cost for England of producing 1 length of cloth is 0.50 bushels of wheat, and the opportunity cost for England of producing 1 bushel of wheat is 2 lengths of cloth!

The opportunity cost of wheat is lower in Canada than in England, so Canada has a comparative advantage in wheat

The opportunity cost of cloth is lower in England than in Canada, so England has a comparative advantage in cloth

The point: opportunity cost depends on relative costs, no absolute costs!

WHENEVER OPPORTUNITY COSTS DIFFER, SPECIALIZATION AND TRADE CAN INCREASE THE WORLD PRODUCTION OF BOTH COMMODITIES, WHICH LEADS TO INCREASED CONSUMPTION POSSIBILITIES

*to note: increased production does not necessarily lead to increased consumption, and standard of living depends on consumption rather than production (so a country could produce a whole lot of products, but if its workers make very low factor incomes, and are hence unable to consume many goods, that country's standard of living may still be extremely low.)

ABSOLUTE ADVANTAGE DOES NOT LEAD TO GAINS FROM TRADE!

If Canada can produce 100 wheats or 60 cloths given one unit of input

and England can produce 10 wheats or 6 cloths given one unit of input

Canada has the same absolute advantage of England in terms of both products, but each country has the same opportunity costs in terms of producing each good. Because of this, specialization and trade will NOT lead to any gains for either country, nor will it increase world output of either product.

There are other reasons in addition to comparative advantage that can make it beneficial to engage in specialization and trade

Basically, whenever OC's differ for the same products between different countries, specialization (and subsequent trade) leads to an increase in net production of goods, and as a result, a decrease in costs, because of...

1: Economies of Scale- Trade creates a larger market for domestic producers (who, after international trade, provide products for consumers around the world instead of just domestically)

2: Product Differentiation- A large international market for any type of product leads to further specialization, or product differentiation. For an example, in Europe, each country specializes in intra-industry trade. Between Canada and the U.S., each country specializes in a different type of car.

3: Learning by doing- Larger international markets lead to specialization, which leads to "accumulated experience". For an example, the silicon valley area of the United States has gained a reputation for computerized innovation, and as a result of that specialization, people from that area gain experience over time, and become better-equiped to compete in that industry.

Economies of Scale = Production moves to the bottom of the LRAC

Learning by Doing = The entire LRAC shifts downward, so any level of production costs less

-------------------------------------

SOURCES OF COMPARATIVE ADVANTAGE:

1: Natural Factor Endowments

-This is how traditional economists explained comparative advantages

-What each country is "born with"

-This includes both natural resources and climates, as well as social patterns and institutional set-ups

-This natural resource advantage translates into cost advantages (i.e., a very fertile country will not incur as many costs growing food as an arid country)

2: Acquired Comparative Advantages

-This is a newer idea: what each country DEVELOPS can lead to a comparative advantage in certain products

-For an example, social fixtures such as education, healthcare, and social services can create more productive workers

-Research and development can also lead to innovations and localized experience which gives certain nations comparative advantages in certain sectors (like Canada and aerospace engineering, or Korea and shipbuilding)

-------------------------

PATTERNS OF INTERNATIONAL TRADE:

We know that countries should specialize and then trade in goods in which they have a comparative advantage.

So... do countries actually export those goods in which they have a comparative advantage? The answer is YESSSSSSS!

THE LAW OF ONE WORLD PRICE: Internationally traded goods sell at the same price, regardless of which country they are sold in, assuming

-zero transport costs

-it is actually the same good

-competitive markets

-the good is tradable

World price simply equates global supply and demand for any product to determine the equilibrium price

So.........

If one country has a comparative advantage in a certain product which would potentially lead to a lower domestic price for this product than the world price level, instead of simply selling the product at the domestic price level, that country will sell that product on the world market at the (higher) world price level: the domestic excess supply will get sold off on the international market.

THE THEORY OF COMPARATIVE ADVANTAGE IS STILL RELEVANT~!! Sources of those competitive advantages may have changed over the years, but the basic premise of this theory still holds true!

------------------------------------

TERMS OF TRADE: These determine how the gains from trade are shared- in other words, how will the gains in world per-capita GDP be shared among the trading nations.

The Terms of Trade = the ratio of (the price of exports / the price of imports)

OR

The relative international price of imports (how many imports can be purchased per unit of export)

If the terms of trade increase, this is favorable for the nation in question, because they are able to get more imports per export. The reverse is true if the terms of trade decrease.

Unfavorable terms of trade will not be conducive to trade! Basically, if the terms of trade make it so that the OC of obtaining imports is equal to or greater than the OC of producing a product domestically, the country in question will not trade for that product! There needs to be a win-win situation (terms of trade which allow for both countries to enjoy lowered OCs) in order to trade to occur.

-----------------------

International Trade and the PPC:

When there is trade, consumption can differ from production! This means that trade can facilitate changes in production which allow for patterns of consumption which lie outside the PPC!

The slope of the dotted line = the terms of trade (tt)

Basically, given any point on the original PPC, international trade allows that country to trade products with another country at a rate which differs from that given on the PPC (which is usually convex). As you can see, if the country in the diagram specializes and trades, it can reach point B!

By specializing (changing production), countries can optimize their production in order to best take advantage of good terms of trade!

NOTE: Which country wins depends on the terms of trade (the slope of the line). Also, the consumption pattern (the point on the CPC) which each country settles into will depend on their preferences between the two products being compared.

Also, most countries have increasing OCs with increased specialization, and thus they have convex PPCs

That's all for now!

M’sian education sector set for next boom phase

KUALA LUMPUR: While the property sector now is in a flurry of consolidation through mergers and acquisitions, kicked off by UEM Land Bhd’s acquisition of Sunrise Bhd, followed swiftly by the just announced mergers of MRCB Bhd with IJM Land Bhd and Sunway Holdings Bhd with Sunway City Bhd, the education sector still remains ‘under the radar’.

MORE STUDENTS: The government is set to intensify its efforts to garner more students from the Middle East, China, Africa and other parts of South East Asia into Malaysia. - Photo from destination360.com

However, the fast growing private education business in Malaysia, which is currently valued to be worth some RM7.2 billion, seems to be stirring of late.

Ekuiti Nasional Bhd’s (EKUINAS) recent 51 per cent acquisition of APIIT/UCTI Education Group from Sapura Resources Bhd is seen as trailblazer for consolidation in the private education sector.

This is because of more outright acquisitions, mergers and the entry of fresh foreign players in time to come.

“There will be more mergers in the works as education entities that don’t merge may risk being left behind.

“There is urgency for smaller players to bulk up for scale and build up quality as the more renowned and established international players which have made their presence in Malaysia pose healthy competition to the growing market,” said Zakie Ahmad Shariff, chief executive of FA Securities Bhd and a former director of EduCity in Iskandar Malaysia.

This is more so as education has been identified as one of 12 National Key Economic Areas (NKEAs), with private education leading the

charge in catapulting Malaysia into the fastest growing education hub in South East Asia.

Malaysia has already become the 11th largest education exporting country with approximately 90,000 international students from more than 100 countries studying here in various international schools, colleges and universities.

Among the listed educational entities are Sapura Resources, SEG International Bhd, Help International Corp Bhd and Masterskill (M) Education Group Bhd.

Associate Professor Dr Rohaida Mohd Saat of the Faculty of Education, Universiti Malaya, lauded the move by EKUINAS and Sapura, saying, “the time has come for private colleges to merge, so as to gear themselves towards creating scale and meeting the increasing demands of foreign students flocking to Malaysia.”

Professor Dr Saifollah Abdullah from the Faculty of Applied Sciences at Universiti Technologi MARA said the Ekuinas Sapura pact was a perfect example of public-private partnership in the education sector.

The Education NKEA has been targeted to more than double the total gross national income to RM60.7 billion by 2020 from the current RM27.1 million.

Commenting on Malaysia’s attraction as an education destination, Dr Muhammad Azhar Zailani from the Faculty of Education, Universiti Malaya, said this is due to the competitive course fees, wide range of study options, many choices of universities and colleges and the existence of branch overseas university campuses.

“This allows students from different parts of the world to come to Malaysia, acquire prestigious qualifications from well-known universities from the West at an affordable price,” he said.

Aside from quality education, experts cite affordable living expenses, an economically sound and safe country and geographically safe environment as the main factors set to grow the education sector.

The government is set to intensify its efforts to garner more students from the Middle East, China, Africa and other parts of South East Asia into Malaysia.

To further build Malaysia’s participation in the global education sector, the government is also encouraging branch campuses of Malaysian educational institutes to go overseas.

Several Malaysian institutes of higher learning have branches overseas, including UCSI University and Limkokwing University in London.

Dr Muhammad Azhar said educational establishments must look towards merging with other established entities or be part of a larger educational network.

A notable example is INTI Educational Group that was acquired by Laureate International Universities from the United States.

With a presence in 21 countries globally, it has now become a leading educational establishment in the Malaysia as well.

Laureate said the reason why Malaysia was chosen as a preferred destination was its emphasis on infrastructure facilities and the government’s emphasis on developing Malaysia into an education hub.

In recent years, Kuala Lumpur, Petaling Jaya, Subang Jaya and Nilai have seen the mushrooming of many educational enclaves or precincts, attracting many foreign students in the process.

Malaysian educational players have also acquired smaller players and enlarged their base through listing their business as a way of tapping into greater capital resources as well as increasing student enrolment.

A case in point is HELP International Corporation Bhd and INTI Universal Holdings Bhd.

The listed holding companies of these educational establishments have strong collaboration with various overseas universities and attract many overseas students who want to acquire quality education at a reasonable cost.

Sapura Resources, which until recently held 100 per cent of APIT/UCTI Education, decided to divest 51 per cent of its stake to EKUINAS while holding the remaining 49 per cent along with management rights.

Now it appears both SAPURA and Ekuinas are in a better position to take advantage of the growth prospects of the fast-expanding education sector.

While some were quick to point out that Sapura was divesting from education, other observers argue that Sapura had in fact reinforced its commitment to the sector by getting a partner in order to grow its stake in the business. — Bernama

MORE STUDENTS: The government is set to intensify its efforts to garner more students from the Middle East, China, Africa and other parts of South East Asia into Malaysia. - Photo from destination360.com

However, the fast growing private education business in Malaysia, which is currently valued to be worth some RM7.2 billion, seems to be stirring of late.

Ekuiti Nasional Bhd’s (EKUINAS) recent 51 per cent acquisition of APIIT/UCTI Education Group from Sapura Resources Bhd is seen as trailblazer for consolidation in the private education sector.

This is because of more outright acquisitions, mergers and the entry of fresh foreign players in time to come.

“There will be more mergers in the works as education entities that don’t merge may risk being left behind.

“There is urgency for smaller players to bulk up for scale and build up quality as the more renowned and established international players which have made their presence in Malaysia pose healthy competition to the growing market,” said Zakie Ahmad Shariff, chief executive of FA Securities Bhd and a former director of EduCity in Iskandar Malaysia.

This is more so as education has been identified as one of 12 National Key Economic Areas (NKEAs), with private education leading the

charge in catapulting Malaysia into the fastest growing education hub in South East Asia.

Malaysia has already become the 11th largest education exporting country with approximately 90,000 international students from more than 100 countries studying here in various international schools, colleges and universities.

Among the listed educational entities are Sapura Resources, SEG International Bhd, Help International Corp Bhd and Masterskill (M) Education Group Bhd.

Associate Professor Dr Rohaida Mohd Saat of the Faculty of Education, Universiti Malaya, lauded the move by EKUINAS and Sapura, saying, “the time has come for private colleges to merge, so as to gear themselves towards creating scale and meeting the increasing demands of foreign students flocking to Malaysia.”

Professor Dr Saifollah Abdullah from the Faculty of Applied Sciences at Universiti Technologi MARA said the Ekuinas Sapura pact was a perfect example of public-private partnership in the education sector.

The Education NKEA has been targeted to more than double the total gross national income to RM60.7 billion by 2020 from the current RM27.1 million.

Commenting on Malaysia’s attraction as an education destination, Dr Muhammad Azhar Zailani from the Faculty of Education, Universiti Malaya, said this is due to the competitive course fees, wide range of study options, many choices of universities and colleges and the existence of branch overseas university campuses.

“This allows students from different parts of the world to come to Malaysia, acquire prestigious qualifications from well-known universities from the West at an affordable price,” he said.

Aside from quality education, experts cite affordable living expenses, an economically sound and safe country and geographically safe environment as the main factors set to grow the education sector.

The government is set to intensify its efforts to garner more students from the Middle East, China, Africa and other parts of South East Asia into Malaysia.

To further build Malaysia’s participation in the global education sector, the government is also encouraging branch campuses of Malaysian educational institutes to go overseas.

Several Malaysian institutes of higher learning have branches overseas, including UCSI University and Limkokwing University in London.

Dr Muhammad Azhar said educational establishments must look towards merging with other established entities or be part of a larger educational network.

A notable example is INTI Educational Group that was acquired by Laureate International Universities from the United States.

With a presence in 21 countries globally, it has now become a leading educational establishment in the Malaysia as well.