Now we're going to explore the idea of efficiency

PRODUCTIVE EFFICIENCY:

-This is when firms minimize the cost of inputs required to produce a given number of outputs

-This is also when firms maximize the quantity of outputs given a set combination of inputs (or set amount of money to spend on inputs)

-This is maximizing the input/output ratio (the greatest bang for your buck)

-Either hold output constant and minimize inputs (in other words, get on the LRAC curve, because the LRAC shows the combination of inputs which will cost the least in order to produce any quantity of output): This is the condition needed to reach productive efficiency for individual firms

OR

-Hold inputs constant and maximize outputs (get on the Production Possibilities Boundary)

In order for the industry to reach productive efficiency, each individual firm must have the same marginal costs because if one firm has lower marginal costs, then it is more efficient for that industry to switch to favor the lower cost producer.

CONCLUSION: In order to reach the production possibilities boundary for any one industry, both individual firms and entire industries must be productively efficient

ALLOCATIVE EFFICIENCY:

-The Allocative Concept is build around the idea of Pareto Optimality: a scenario where we cannot make someone better off without making someone else worse off. The allocative concept states that it is good to reach Pareto Optimality, because there, the mix of commodities which are produced match the mix of commodities which are desired by consumers. Allocative efficiency refers to a quality of an entire industry- not just an individual firm. While there can be many productively efficient points on a production possibilities boundary, only ONE of these is allocatively efficient.

-Allocative efficiency is one definition for "the best society can do"

CONDITIONS FOR ALLOCATIVE EFFICIENCY:

-We know that consumers will buy any one product up until the marginal benefit equals the marginal cost of that product

-The marginal benefit is the marginal value of any unit of a product minus the price

-THEREFORE, consumers buy units of a product until the price is equal to the marginal cost

-Perfect competition uses MARGINAL COST PRICING

-If the marginal benefit to the consumer outweighs the marginal cost to the producer, too little is being produced from society's viewpoint

-If the marginal benefit to the consumer is smaller than the marginal cost to the producer, then too much is being produced from society's viewpoint

ALL INDUSTRIES MUST EQUATE PRICE TO MARGINAL COSTS in order to that industry to be allocatively efficient

ECONOMIC SURPLUS MAXIMIZATION:

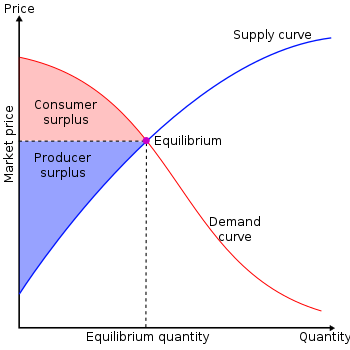

-Economic surplus maximization is allocatively efficient because it maximizes total surplus for all members of society

-This occurs when the price is equal to the point where demand equals supply (as it will in perfect competition). Here, total economic surplus is maximized and there is no dead weight social loss

-With free markets (where demand and supply naturally reach an equilibrium), it is impossible to make either the producers or the consumers better off without hurting the other: THIS IS PARETO OPTIMUM! This is the best scenario for society!

To test for allocative efficiency, we must ensure that:

-Price is equal to marginal cost

-Total economic surplus is maximized- there is no dead weight social loss!

--------------------------

PRODUCTIVE AND ALLOCATIVE EFFICIENCY WITH A PPC Curve

ANY POINT ON THE PPC IS PRODUCTIVELY EFFICIENT, because by definition, the PPC is the maximum level of output where all inputs are fully employed and productively efficient

ONLY ONE POINT ON THE PPC IS ALLOCATIVELY EFFICIENT, because only one combination of outputs will exactly match consumer's demands. On any other point, a tradeoff could be made in order to better one group of consumers without making anyone worse off. At the one point of allocative efficiency, no one can be made better off.

It is possible to produce too much or too little of either product.

REMEMBER: If the price is lower than the marginal cost, the producer is getting ripped off. Meanwhile, if the price is higher than the marginal cost, then the consumer is getting ripped off.

-----------------

EFFICIENCY IN PERFECT COMPETITION AND MONOPOLIES

PERFECT COMPETITION

CONDITION ONE: Is each firm producing on the LRAC in the long run? YES, because in the long run, all firms in perfect competition will produce at minimum efficiency scale.

CONDITION TWO: Is the marginal cost equal for all firms? Yes, because all firms in perfect competition face the same prices, and at the MES output level, marginal cost will = the price for all firms!

As a result, no reallocation among firms can lower industry costs: Firms in perfect competition are productive efficient!

In perfect competition, firms maximize their profits by producing where the price is equal to the marginal cost (marginal cost pricing). This will guarantee Pareto Optimality if all firms are in perfect competition: Why? Because here, there is no deadweight social loss, so both consumer and producer surpluses are maximized

Any output greater than or less than QE will reduce the total sum of producer and consumer surplus

IN SUMMARY: For perfect competition,

-Firms will produce at the minimum efficiency scale, so individual firms are productively efficient

-Marginal costs are equal for all firms, so the industry is productively efficient

-Price is equal to the average cost minimum, so in the long run, firms only make normal profits

-Price = marginal cost, so this market structure is allocatively efficient

MONOPOLIES AND EFFICIENCY

Monopolies are productively efficient!

-In the long run, the monopolist will be on the long run average cost curve (although not necessarily at MES). Why? Because monopolies want to maximize their profits by minimizing costs.

-This is productively efficient

-NOTE: The long run average cost for monopolies may be abnormally high (due to high fixed costs and excess capacity)

Monopolies are not allocatively efficient in the long run!

-To maximize profits, monopolies produce where marginal revenue equals marginal costs

-BUT, marginal revenue falls much more quickly than average revenue (price) as output increases, and thus, price will be greater than the monopolist's marginal costs at the monopoly's selected output level

-Because MC < P, the consumer is getting ripped off in a monopoly, and as such, monopolies are allocatively ineffienct

P > MC

Price is higher and quantity produced is lower than it would be if that same industry was in perfect competition

There is a deadweight social loss

WHEN INDUSTRIES CARTELIZE, THERE IS A DEADWEIGHT SOCIAL LOSS

See?

No comments:

Post a Comment