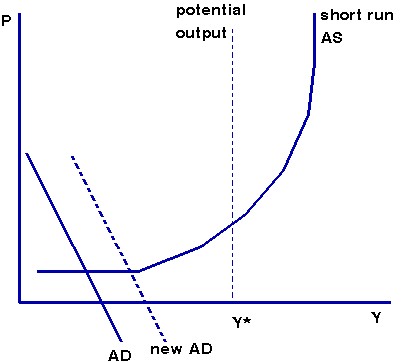

The short run aggregate supply curve shows the amount which firms are willing to produce at any given price level.

Aggregate Supply is positively sloped!

Why?

Well, as firms increase output and input prices are constant, the law of diminishing marginal returns causes marginal output per factor to fall, and the short run average cost to rise. THUS, in order to retain expected profit margins, the only way for producers to feasibly increase production is to increase the price of goods: as such, as price rises, the actual GDP/output which firms will produce increases- there is a positive relationship here.

What about the slope? Why is it increasing?

Well... at low levels of output, firms have excess capacity, so they are capable of increasing output without making a huge investment, and the law of diminishing marginal returns hasn't really kicked in yet. Production can be increased at a relatively low cost (this corresponds to the flatter part of the curve)

At higher levels of output, however, there is no excess capacity, and great costs must be incurred to increase production.

Aggregate supply can shift (we call this an aggregate supply shock!). Basically, anything which would cause the cost of inputs (wages, intermediate goods, machinery, etc.) to rise OR anything which lowers the productivity of those factor inputs (like a rainy day on a farm) will shift the aggregate supply curve to the left (and consequently, lower input costs shifts AS to the right)

No comments:

Post a Comment