-They can enforce economic regulation (and punish firms who misbehave)

-They can draft competition policy (and create an economic environment conducive to competition)

The big issue here is market power versus rivalry. Generally, market structures closer to perfect competition are seen as preferable, but this must be qualified- perfect competition and efficiency are not always the best outcomes for society.

-Efficiency is not always the only goal for society. For instance, an industry may be the most cost efficient if it outsources labour to a Malaysian sweatshop, but but many people see wage slavery as unethical, and would rather pay a higher price for FAIR TRADE goods than inexpensive but guilt-inducing free-trade products

-Private Costs to Industries do not include social costs, such as environmental damage. A highly economically efficient production process may incur a high external cost to society through the accumulation of dangerous pollution, etc.

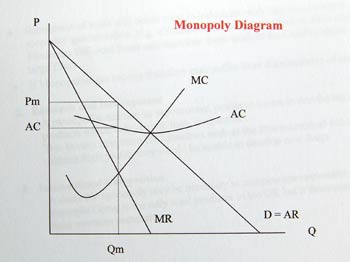

-Costs are not independent of market structure. If there are economies of scale inherent in the market, perfect competition may divide up market shares to the point where the minimum efficiency scale would provide for more products than is suitable for each firm to maximize profit. As such, a shift to a monopoly structure may be more efficient (as in the power industry, landline telephones, and other tentacle industries)

-Monopolies may be necessary for innovation. Generally, the size and profits of monopolies give them more economic freedom to invest in research and development (for an example, drug companies receive patents which grant them the exclusive right to sell new drugs they develop because this monopoly profit incentive drives new research)

-Also a competitive desire from external firms hoping to enter an industry may drive innovation (as seen in cell phones, email, solar panels, and other new technologies which de-emphasize monopoly power in certain sectors.

-------------------------------------

Economic Regulation to Promote Efficiency!

Controlling Natural Monopolies (Industries where scale economies and high fixed costs permit only one firm to operate at minimum efficiency scale, and discourage other firms from entering the industry- tentacle industries like electric companies): There are two options

-Buy up the monopoly and turn it into a state-owned Crown Corporation

-Allow private ownership to continue, but regulate the monopoly firm (using bodies like the Canadian Radio and Television Commission, for instance)

If the government chooses to regulate, or if it chooses to buy up a tentacle it must dictate the pricing policy for that industry:

-It can induce marginal cost pricing, and sell where the demand-determined price is equal to the marginal cost of producing the final unit

-It can induce average cost pricing, and sell where the demand-determined price is equal to the average cost of producing the final unit

-It can induce a "rate of return" legislation, where regulated firms are allowed to a small percentage of returns (eg: 5% profit)

MARGINAL COST PRICING:

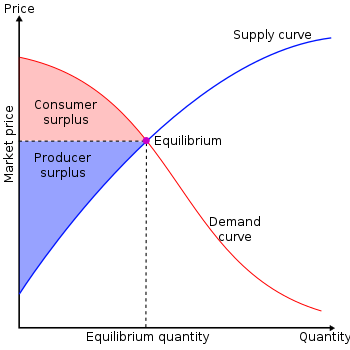

Here, demand = supply, and price = marginal cost. The major benefit of this pricing model is that it allows for allocative efficiency (so there is no deadweight social loss). However, this is not the profit maximizing output where marginal revenue is equal to marginal costs, so there is an inherent conflict between the governments desire for allocative efficiency, and the firm's desire for profit.

As is shown be the green box in the diagram, when a natural monopoly with falling average costs uses marginal cost pricing, it incurs an economic loss (the price is lower than the average cost here, thus a loss is generated by producing at this output level). Usually, this loss must be offset with government subsidies (aka: taxpayer money)

REMEMBER: TR (Price at output level X output produced) - TC (average cost at output level X output produced) = A LOSS IN THIS CASE

----------------

AVERAGE COST PRICING

Here, monopolies are forced to produce an output where demanded determined prices are equal to the average cost of producing at that output level. This means that total costs will = total revenues, so the firms here will make normal profits, and there will be no need for a subsidy. On the other hand, this pricing model is less allocatively efficient, as Price is not equal to the marginal cost of production here, and the quantity produced is less than what is required for maximum total economic surplus (so a deadweight loss is generated).

Which is better? Well, that's a value judgement. Marginal Cost Pricing is allocatively efficient, but requires costly subsidies. Average cost pricing is not allocatively efficient, but will not require subsidies.

Rate of Return pricing lets monopolies keep a "fair" profit. Here, allocative efficiency is ignored. A big problem with this pricing model is determining what is "fair".

-----------------

DIRECT CONTROL OF OLIGOPOLIES

-Historically, the government has controlled entry into certain industries (such as postal services and air travel) in order to protect crown corporations from competition.

-Recently, however, government intervention has become less popular. Crown corporations are increasingly becoming privatized, while regulated industries are becoming deregulated. An example of this is the open skies policy for airlines. Originally, Air Canada operated as a monopoly in Canadian air travel, and would often cross-subsidize airfare (so flyers traveling from Calgary to Toronto would pay extra so that travelers going from Vancouver from Nunavut would not have to pay as much [The UBC bookstore also does this to find student activities]). Now, Westjet has broken up that monopoly, but there is still legislation in place to prevent non-Canadian airlines from carrying passengers from one Canadian city to another.

Why is the government moving out of direct control for oligopoly markets?

-Oligopolies are a good source of innovation

-Cross subsidization which was used by crown corporations in the past is now not seen as economically sound

-There has been a great deal of corruption and cross fertilization between regulators and the industries they supposedly regulate (often, because employees at regulatory agencies later wish to seek employment in the industries they have previously regulated in order to make more money and help firms find regulatory loopholes)

-As such, regulators often favor producers over consumers

-Crown corporations do not improve labour relations and efficiency (just take Canada Post, and disgruntled postal unions for an example)

-International competition makes subsidies inefficient

The government strives to "maintain and encourage competition in Canada" - section 2 of the competition act

----------------------------------------------------

CANADIAN COMPETITION POLICY (The carrot approach)

-Using this, the government tries to create a good balance between market power and efficiency.

In the combines investigation act (1889), the government created explicit restrictions in terms on non-competitive behavior under the larger legal umbrella of criminal law. There were four basic areas.

a) Conspiracy (this forbade explicit collusion)

b) Merger (this forbade companies from joining together or buying their competitors. Amusingly, this was originally intended to break unions apart, as unions were seen as creating a monopoly in labour markets and restricting trade and efficiency)

c) Monopoly-abuse of dominant position (Although this was seen as hypocritical by many firms, as the government favored competition, yet would penalize firms who were successful in negotiating markets and eliminating their competitors)

d) unfair trade practices

In 1986, this was replaced with the Competition Act, and the competition tribunal (a special economic court with economists acting as judges). Its purpose is to "maintain and encourage competition in Canada".

INDICTABLE OFFENSES (Things you can go to jail for doing)

-Conspiracy (explicit collusion)

-Bid Rigging (for firms who do contract work, bid rigging is a method of collusion)

-Illegal Trade Practices (such as giving certain buyers preferential discounts

-Misrepresentation (lying about costs or profits for instance)

-Telemarketing

-Double ticketing (having two sticker prices for a particular good)

-Pyramid Selling

Matters Reviewable by Tribunal (slightly less bad, but still suspicious)

Abuse of dominant position

-squeezing

-fighting brands (like the 'life' brand)

-Pre-emption (preventing entry)

-Predation (predatory pricing to eliminate competition over the long run)

-Mergers (Which cause a significant loss of competitive behavior) *** unless the raised consumer prices faced due to decreased competition can be offset by the productivity gains and lowered production costs brought about by the merger

THATS ALL!