Okay! Last lecture was all about firms. Now today, we're gonna talk about how we derive the Short-run supply curve. We must examine the theoretical link between price and quantity produced!

Price --------> [?]----> Quantity Supplied

What is the missing link???

PROFITS!!!!

We assume, as economists that producers (like consumers) want to be as happy as possible. Instead of maximizing utility, however, consumers are made the most happy by maximizing total profits!

Total profits = total revenue - total costs

TOTAL REVENUE

-total revenue = price X quantity

-Total revenue is changes based on different kinds of markets (there are different revenue curves for markets with perfect competition, imperfect competition, and monopolies. We talk about all of these in the upcoming chapters!)

TOTAL COSTS on the other hand are the same for each market structure. We're gonna talk about total costs in this chapter!

OKAY! Let's think about production! What is production?

Well... production is the transformation of various inputs into outputs, which is performed by a firm. For an example, when joe the employee, rent for a smoothie shop, electricity, a blender, yoghurt, mangoes, and bananas are used together to create a mango-banana smoothie, THAT is production.

INPUTS are the factors of production (factors)

OUTPUTS are goods and services (commodities)

There are 5 factors of production

Capital- (Plant or Factory, Equipment, Inventory, and Residential Inputs)

Land- Natural Resources

Labour- Human Resources (Employees)

Technology- Changes and innovations in the production process

Entrepreneurship- Innovation, Invention, Research and Development (new and exciting ideas)

THE PRODUCTION FUNCTION: Maximum output is a function of inputs

For the sake of simplicity, we focus on the relationship between 2 inputs: Capital and Labour.

TP = f (Labour, Capitol)

Let's say we've got an office where we produce written letters using secrataries. The number of letters written is a function of the office infrastructure and the number of secrataries employed.

COSTS: The value of the factor used up in production (the value of inputs)

REMEMBER: Opportunity costs determine decision-making in the firm (inputs are valued depending on their next best allocation, not their sticker-price). We call the costs with ppportunity cost factored in the IMPUTED OR IMPLIED COST (OR IN GATEMAN'S LECTURES, THE OPPORTUNITY COST).

The Accounting Cost is not something we look at in Economics. It is used in business school, and merely includes the explicit invoice prices of factors. It does not take the owner's time and money, for example, into consideration.

SUNK COSTS, however, are not factored in to opportunity cost, because they have no alternative use (or salvage value). In other words, they have No 'next best' allocation. An example of a sunk cost would be a computer program which is designed and purhcased specifically for your business. This input cannot be used any other way, so Opportunity cost is 0, and it is a sunk cost!

PROFITS!

ACCOUNTING PROFIT = total revenue - Accounting costs (the sticker prices of inputs). This does not include opportunity costs.

ECONOMIC PROFIT = Total Revenue - Total Costs (and includes opportunity costs). This is also known as pure profit, supra-normal profit, or in an econmics class, simply 'profit'. It basically measures profit compared to other opportunities. In order to understand economic profit, it is important to understand the idea of normal profit.

NORMAL PROFIT is actually a cost. It is the cost of technology and entreprenuership, or the implicit cost of risk taking. It is the cost of choosing to devote time and money into a certain business instead of simply putting money in the bank or working at the next-most-profitable business. For an example, if I can make 5% returns on my money in the bank, then those 5% returns are considered normal profit, and should be added to my economic costs. In the long run, the profit level of surviving firms (after a business trend has come and gone) can be seen as the normal profit.

When a firm is making no economic profit, we say that it is allocatively efficient.

Firms can make accounting profts, but no economic profits. If this is the case, we know that the firm would be better off using their resources in a different way to make more profit.

Economic profit in a particular sector acts as a sugnal for firms to enter that sector. Conversely, economic loss is a signal for firms to exit the market for that sector! Pretty cool, hey?

NOW.. let's try and get into the idea of cost curves.

We know that profit is total revenue minus total costs. We don't know how to determine revenue quite yet, but we're going to learn how to determine costs. Now, we're going to have a closer looks at how total costs relate to quantity. Cost theory is similar for all firms, no matter what the revenue market is.

OKAY: There are 3 different cost scenarios:

THE SHORT RUN (Operating Decisions): at least one of the input factors is fixed. Q = f (variable factor, fixed factor)

THE LONG RUN (Planning Decisions): all factors are variable except technology. Q = f (variable factor, variable factor)

THE LONG RUN (Growth Decisions): all factors are variable including technology. Q = f (variable factor, variable factor, with variable technology)

In other words, time isn't actually a factor- it just depends on whether facors are variable or not. The short run could extend for years in some industries, while the long run may only last a few weeks in other industries.

NOW FOR THE COST CURVE:

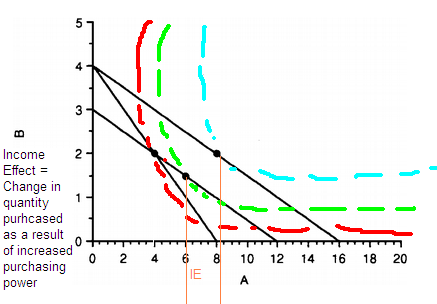

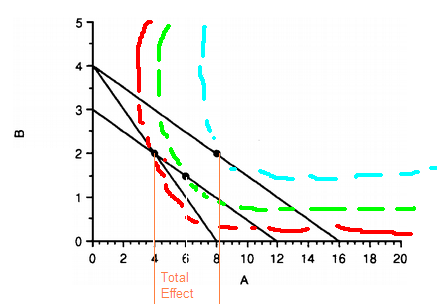

from 0-3 is specialization

from 3-7 is saturation

from 7-8 is congestion

Usually, when you initially add more people (labour), division of labour and specialization can happen! As a result, efficiency increases, so the total product (grapgically represented as a lazy S) rises at an increasing rate.

Since production is a function of labour, it looks like the additional unit of labour (extra worker) added after the first worker can produce 2 extra products. In real life, the extra worker allows both the new worker and the old worker to produce 1.5 products (for a total of 3). The average product (total output per worker, represented as a slope of a ray from the origin on the total product curve) is 1.5, and the marginal product (extra productivity added by the last hired worker represented as the slope of the tangent of the product curve) is 2.

AP = quantity produced/number of workers = 3/2 = 1.5

MP = change in quantity/change in number of workers = 2/1 = 2

The marginal production rate always intersects the average production rate at it's maximum. This is because the average rate will continue to logically rise until an additional worker will no longer cause an increase in productivity. If a worker is added whose added productivity is exactly the same as the present level of productivity, then the average productivity will be equal to the marginal productivity. Any point after this in which another worker's marginal productivity will be lower than the average productivity, and will therefore cause the average to decrease.

After a certain point (the inflection point), each additional worker still adds to total productivity, but at a decreasing rate. Here, total productivity is rising, and marginal productivity is positive, but falling. This is called saturation.

Eventually, due to overcrowding and other inefficiencies (400 people in a tiny office for example), addional workers will actually cause a decrease in total productivity. Here, margical productivity is negative, and falling, and total productivity is decreasing.

This is for situations when Output is a function of Capital and Labour.

WE CAN USE THIS TO FIND THE COST CURVE!

There is a law of diminshing marginal product, which states that after a certain point (the inflection point), adding more of the variable factor will dimish the additional output generated by that extra variable factor.

Why?

-Because the variable factor has less of the fixed factor to work with (EG: 12 secratories sharing 4 computers). This is the reason for the shape of the product curve

.

.